Assessor

THE JOB OF THE ASSESSOR IN NY STATE

The Assessor’s job is to value real property within a municipality for taxation purposes. The Assessor is responsible for preparing an assessment roll of all real property, vacant and improved, within the Town, and establishing the condition, value and taxable status of each parcel of property each year. The valuations determined by the Assessor are utilized to apportion the amount of Town, County, School, and Special District taxes to be levied on each parcel.

Duties of an Assessor also include researching and maintaining essential statistics on all town property, updating property cards and computer-entering parcel and building inventory data, updating the digital photo database, performing market studies and research, as well as receiving and processing real property exemptions and responding to taxpayer inquiries.

Assessment administration is governed by NYS Real Property Tax Law, as well as case law. Assessment support is provided by the Office of Real Property Tax Services (ORPTS), a division of the State’s Department of Taxation and Finance. This oversight agency facilitates the administration of assessments and real property tax services throughout New York State and establishes the assessment to market value ratios each year in every municipality.

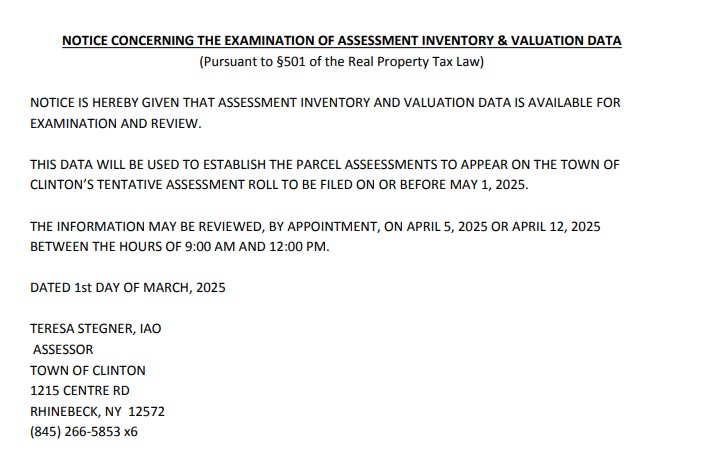

GRIEVANCE DAY

Pursuant to §508, §512, & §525 of RPTL

NOTICE is hereby given that the BOARD OF ASSESSMENT REVIEW for the Town of

Clinton, County of Dutchess, shall hear and examine complaints in relation to assessments at:

Clinton Town Hall (Masonic Building), 1215 Centre Road; Rhinebeck, NY; (845) 266-5853 option 5

The BOARD OF ASSESSMENT REVIEW will be in attendance on the following days:

Wed. May 28, 2025 BETWEEN THE HOURS OF 4:00 pm and 8:00 pm

The BOARD OF ASSESSMENT REVIEW will then file a copy of the determination with the

Town Clerk to become a matter of public record.

TOWN OF CLINTON GENERAL ASSESSMENT and GRIEVANCE INFORMATION

All exemption applications are due by March 1.

Common local exemptions adopted by the Town of Clinton include the Senior Citizen, Alternative Veterans, Disabled with Limited Incomes, and Agricultural exemptions.

STAR

The STAR program is now administered by NY State. Only newly eligible senior citizens 65 or older who currently receive the Basic STAR Exemption (not a STAR check), can apply through the Assessor’s Office to receive the Enhanced STAR (RP-425-E) on future school tax bills.

New homeowners and those not currently receiving a STAR Exemption, will apply through NY State to receive a STAR credit check. Call NYS DTF at (518) 457-2036 for STAR information.

Grievance Day

If you disagree with the assessment of your property after reviewing the tentative assessed value, established on or about May 1 of each year in the Town of Clinton, you may file a complaint on real property assessment (form RP-524) by the Town’s Grievance Day – the fourth Wednesday after the fourth Tuesday in May.

The Board of Assessment Review (BAR), a separate board consisting of 5 residents of the town appointed by the Town Board, will make a determination on each properly filed complaint (grievance), and further judicial review (SCAR or Article 7) may be pursued if the decision of the BAR does not meet the requested assessment reduction.

If you have any questions for the Assessor, please call (845) 266-5853 x6 and then press 1.

Please leave a message and your call will be returned. If you have any questions or need information, contact the Assessor’s Office at 845-266-5853 Press 6.

Questions? Please contact Teresa Stegner, Assessor at 845-266-5853 Option 6